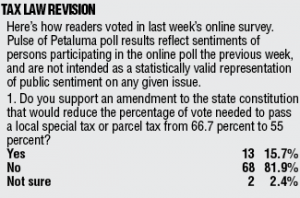

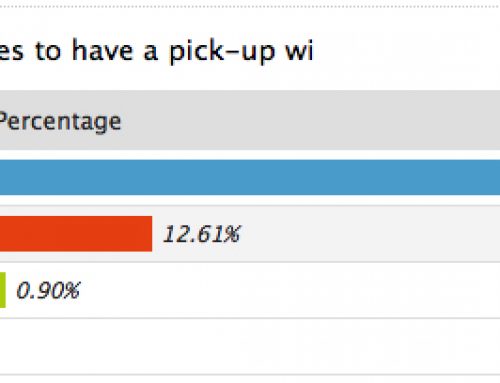

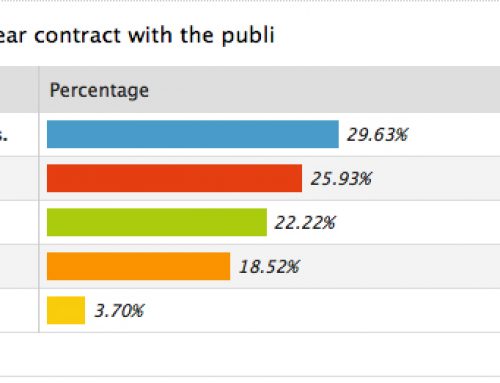

The majority of those responding to this week’s Argus-Courier online poll believed that tax laws should not be revised to reduce the percentage of vote needed to pass a local special tax or parcel tax from 66.7 to 55 percent. Only 15.7 percent supported the change and 2.4 percent weren’t sure.

Here were some of the comments.

——

“By reducing the percentage of votes necessary to pass a measure it would give the minorties a huge edge in passing a measure for the special interest groups. It would/could make the debt upon each community much worse than it already is. It must stay the same.”

——

“I’d go for the lower percentage if only those who could vote on the parcel tax were those who owned property, not those who did not! Voting to tax the other guy and not yourself is just like extortion!”

——

“I’m saddled with enough parcel taxes as it is. I’d rather not make it easier for them to pass.”

——

“I don’t think the state should determine the rules for city and county taxation. Even with cutbacks, I still believe we have a spending problem. We’re also too quick to vote for taxing other people for services we want.”

——

“I think that if you don’t own a parcel then you shouldn’t be allowed to vote on increasing parcel taxes. Those taxes don’t effect them.”

——

“The next step is to fix the commercial property tax loophole in Prop 13 that has allowed countless commercial buildings throughout the state to be sold yet not pay property taxes based on the actual value of the property.”

——

“This could be a burden on seniors if a lot of parcel taxes are passed.”

——

“Absolutely! A two-thirds vote is nearly impossible. What results from such a ridiculous threshold is a tyranny by the minority. Taxes are not a bad thing — it is how we pay for all of “those” services that we take for granted: road repair, intersection lights, police and firefighters, etc etc.”

——

“Parcel taxes are easy targets because the revenue is guaranteed and it is usually supported by those that don’t own property. Passage should be made as difficult as possible. Why should multiple property owners pay extra while non-property owners pay nothing? The focus should be on general use taxes where everyone contributes and not on parcel taxes at all.”

——

“Prop. 13 gutted this state.”

——

“The next step is to fix the commercial property loophole in Prop. 13 that has allowed countless commercial buildings throughout the state to be sold yet not pay property taxes based on the actual value of the property.”

——

“This could be a burden on seniors if a lot of parcel taxes are passed.”

——

Poll: Most say, ‘keep tax laws the same’

(Visited 2 times, 1 visits today)

Recent Comments