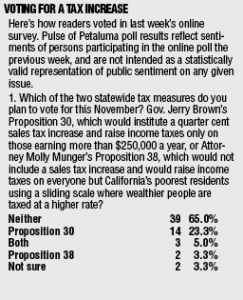

The majority of those responding to an Argus-Courier online poll said they did not favor either income tax increase on the state ballot.

There are two competing taxes on the ballot: Gov. Jerry Brown’s Proposition 30, which would institute a quarter cent sales tax increase and raise income taxes only on those earning more than $250,000 a year, and Attorney Molly Munger’s Proposition 38, which would not include a sales tax increase and would raise income taxes on everyone but California’s poorest residents using a sliding scale where wealthier people are taxed at a higher rate.

About 65 percent said they would vote for neither Proposition 30 nor Proposition 38. About 23 percent said they’d vote for Proposition 30, while just 3 percent said they’d vote for Proposition 38.

Five percent said they’d vote for both, while 3 percent said they weren’t sure.

Here were some of the comments.

——

“California is already driving out businesses to Texas, Arizona and Florida. Stop the tax and spend mentality.”

——

“I will vote for Prop 30 to help the schools. My children got a good education in Petaluma schools. Prop 38 would cost me in excess of $2,000 a year casino online and is excessive.”

——

“Fix the economy and the money will come. Are you listening Gov. Brown?”

——

“Give politicians more money and they will spend more money.”

——

“I’m not voting to give the government any more money until they provide some kind of evidence that they will use it wisely and responsibly. They’ve failed time and time again to be fiscally responsible with our money. They don’t deserve one more cent.”

——

It’s like trying to figure out which of the ugly sisters to date !

——

“Poor management of funds on your part does not make it ok for you to pick my pocket. Sorry.”

——

“The State of California does not have an income problem, it has a spending problem.”

——

“To make up for the increase, I will just buy fewer “fun to have” items. I have already cut back on some purchases just as my personal boycott to Sacramento.”

——

“We are going to chase all of the companies out of California with our taxes. My employer has already opened offices in Texas and Arizona.”

——

Poll: most oppose taxes

(Visited 6 times, 1 visits today)

Recent Comments